As the 2027 deadline for ending support for the existing SAP ERP versions approaches, SAP customers across the globe are actively considering the transition to SAP S/4HANA to harness its transformation capabilities. However, for many modern-day CFOs, this journey can be a bit of a bumpy ride, and realizing the promised benefits can be challenging.

Several factors influence the decision to make this migration, including competitive risk, growth potential, business complexity, the quality of the current SAP installation, and other enterprise systems and data quality.

Once the decision to migrate to S/4HANA is made, the finance and IT leadership team must prepare to understand the challenges and actual benefits and return on investment (ROI) that can be achieved. In our experience, CFOs encounter several challenges from a finance operations transformation perspective during the migration.

Why Modern-day CFOs struggle to Realize Benefits After SAP S/4HANA Migration

Inability to envision the optimized future state: Many CFOs struggle to visualize the optimized state of their operations post-S/4HANA implementation.

Lack of familiarity with S/4HANA features: Existing users of legacy SAP systems may not be familiar with the features of S/4HANA, making the transition more challenging.

Shortage of skilled experts: S/4HANA is an emerging technology, and finding skilled industry experts who can help envision the transformation benefits can be challenging.

Managing ongoing upgrades: Adapting to quarterly cloud S/4HANA upgrades requires careful change management and continuous adjustments.

Disparate functions across locations: When various functions are spread across multiple locations, non-standardized ways of working can hinder efficiency.

Underutilization of automation features: Many organizations struggle to fully utilize the automation capabilities of S/4HANA optimization, missing out on opportunities across finance, supply chain, marketing, sales administration, and more.

At Hexaware, we work from the ground up to ensure that CFOs effectively realize the benefits promised by migration. We assist shared service centers (SSCs) with a 6-step approach to reach their desired target state.

The 6-step Journey to a Desired Target State for SSCs

- S/4HANA consulting: We induct S/4HANA subject matter experts (SMEs) to help uncover S/4HANA best practices, visualize the to-be state, and assess the migration progress effectively.

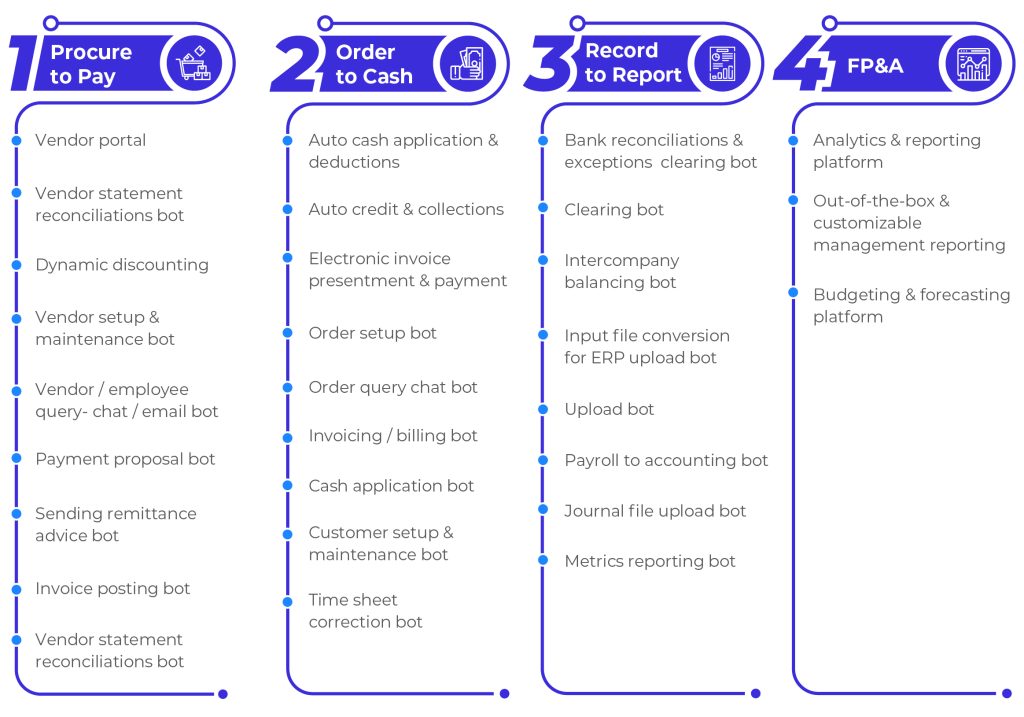

- Automation: We address the technology gaps by integrating intelligent automation solutions into your S/4HANA ecosystem.

- SSC and TOM design: We help design the target operating model (TOM), create to-be state maps for S/4HANA and allied ecosystems, and plan SSC setup in alignment with your cutover to S/4HANA.

- SSC delivery and transformation: We assist with the transition to an outsourced SSC coinciding with your S/4HANA go-live, ensuring smooth operations and post-migration support.

- Business case: We work on a business case that leverages your investment in the S/4HANA ecosystem, committing upfront and day 1 savings of up to 60% with Hexaware’s DMS model.

- Change management: We collaborate on quarterly S/4HANA cloud upgrades and make necessary adjustments to the process documentation, automation, etc.

Hexaware’s Tensai® harnesses our intelligent automation assets to enhance efficiency in various S/4 HANA transformation initiatives:

Finance Transformation Benefits for Organizations Moving to S/4HANA

Organizations migrating to S/4HANA stand to benefit from enhanced efficiency and drive positive changes across various finance metrics such as:

Source to pay

- Hold/exceptions/vendor query reduction

- Duplicate payment reduction

- Accounts payable (AP) debit balance recovery

- Maverick spend reduction

- Vendor satisfaction improvement

- Demand path optimization

- Enhanced discounts realization

- Vendor rationalization

- Improve invoice posting cycle time and vendor satisfaction

- Unallocated payment reduction

- Order cycle time reduction

Order to cash

- Days sales outstanding (DSO) reduction

- Cash conversion cycle reduction

- Reduced customer queries

- Improved collections prioritization and recoveries

- Discount maximization

- Invoicing turnaround time (TAT) and accuracy improvement

Record to report

- Reduced manual journal entries

- On time and accurate filings

- Reduced time to close

- Real time visibility for closing tasks

- Reduced tax discrepancies

- Variances reduction

This approach aims to streamline operations and unlock the true potential of S/4HANA, ultimately helping CFOs achieve their desired financial goals.