Hexaware Strengthens Data Capabilities with Acquisition of Softcrylic Know More

This website uses cookies. By continuing to browse the site, you are agreeing to our use of cookies

Data, data everywhere, but where is the intelligence?

Banking

January 16, 2023

Every day, it is estimated that 2.5 quintillion bytes of data are created, and guess what, banks still aren’t any wiser on their customers’ requirements. Open banking, APIs and fintechs have still not scratched the surface in the realm of external data consumption. In fact, even within the bank, this data is siloed with no enterprise-wide view of the customer. Banks are still too far removed from their customer’s day-to-day motivators, and ecosystem influencers of their buying behaviours and decisions.

Data processing has become a mundane activity, lacking interest and innovation. While some banks are leaning towards technology evangelists bringing in the latest cutting-edge technology without much coverage of business context, at the other end of the spectrum, banks have business goals being missed due to lethargic and archaic, technology conservatives. A middle ground is the need of the hour, achieved by collaborating with niche fintech players focused on domain specific solutions enabled by the banks’ scale and data prowess.

The business users of today need everything here and now, even regulators are moving to straight-through processing, as opposed to after-the-fact periodic reporting. The real-time connotation of data is utopia, when, even the basic bulwarks for data parsing and processing are in shambles, in several banks. Gen Alpha will be even more unforgiving towards the inefficiencies inherent to the current data systems. As a generation weaned on mobility, wearables and digital payments, hyper personalized intelligence will be a basic expectation from the banks of tomorrow. Banks need to invest in reimagining their dated data processes, replacing legacy systems, and re-baselining their controls to prepare for the leap into next-generation banking.

The parameters for success are pegged very high, and hence, will need skills possibly missing at most banks. Identifying resources highly skilled in Cloud, AI and ML, Data Science, and Data Visualization, is an imperative for banks if they wish to pursue the in-house IT shops. Considering the dearth of such skills, an alternative would be to seek out the right partners who can help the bank leverage the right technologies, products and frameworks to achieve these goals at speed and scale.

What banks need today is a Cloud native, fully integrated solution as a one-stop shop for data ingestion, quality, visualization, analytics, and decision science which leverages an out-of-the-box data model. It should be comprehensive and flexible to accommodate the unique data requirements of the bank while leveraging state-of-the-art data science models, AI/ML platforms supporting descriptive, augmented, predictive, and prescriptive analytics, lending to self-service customizable dashboards and reports. Data quality standards should be inherent to provide the basic assurance of reliability and security expected from a repository which shall hold customer sensitive data.

What should your first step be, towards leveraging data?

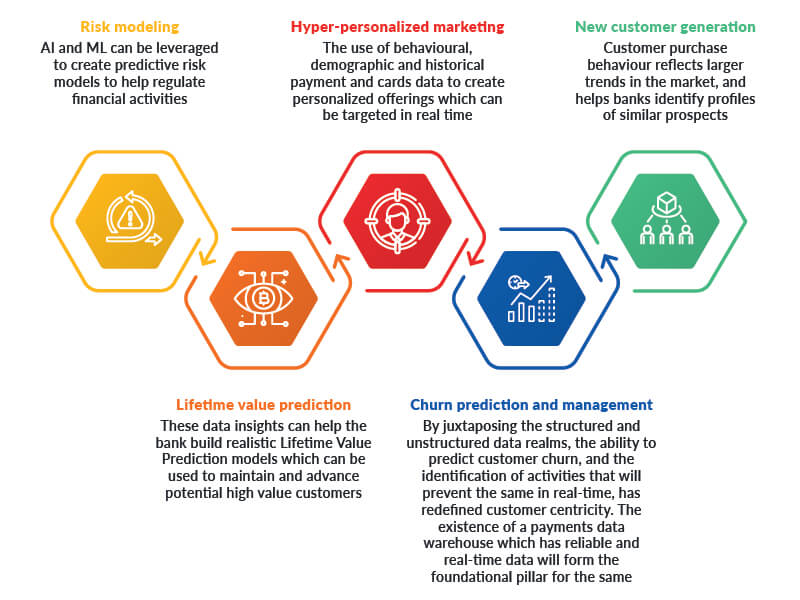

In our experience, a lot of customer and customers’ ecosystem relevant intelligence is hidden in the payments data held by the banks, this data, if truly leveraged can be a true treasure chest for the banks. What the banks will need is a pre-configured data warehouse that caters to the cards and payments data at the bank. This data should be captured from various sources in the bank, absorbed and ingested, and fed through to a data lake. This can then be curated and held in data marts for data visualization or orchestration purposes. AI and ML models can work with this data to provide unanticipated insights, and to create differentiated product offerings with newer streams of revenue.

Some of the potential areas where banks can deploy the application of data are:

Banks looking to reinvent themselves or reimagine their services should consider the above approach to ensure their relevance and resurgence in modern banking. In the Banking-as-a-Service regime, where banks have been relegated to the role of a provider, this goldmine has the potential to help revive their fortunes!

About the Author

Chinmoy Banerjee

Corporate Vice-president & Global Head - Banking & Business Process Services

Read more